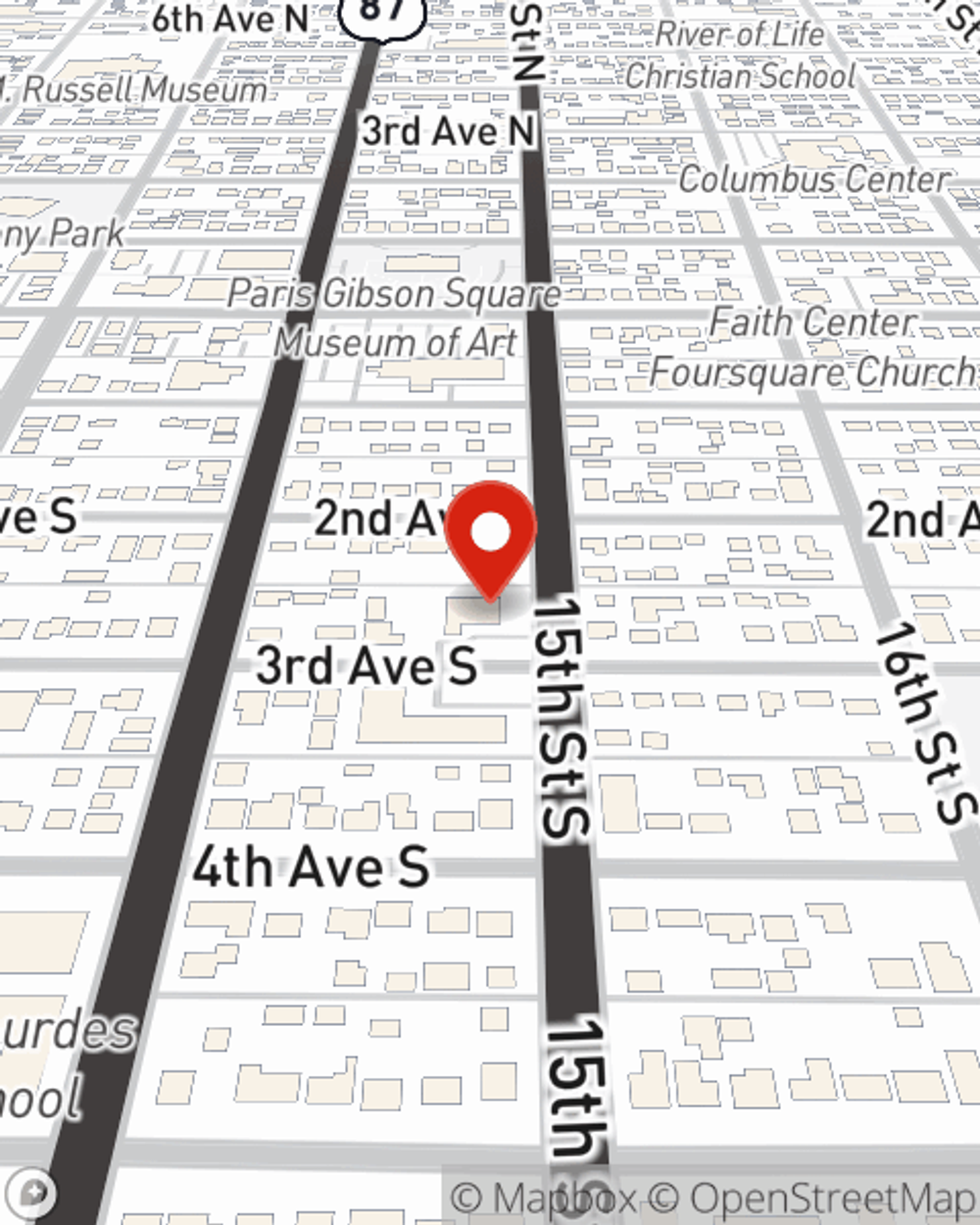

Renters Insurance in and around Great Falls

Welcome, home & apartment renters of Great Falls!

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Montana

There’s No Place Like Home

Your personal property matters and so does keeping it safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your entertainment center to your golf clubs. Not sure how much insurance you need? That's okay! Scott Schissler is ready to help you evaluate your risks and help pick the appropriate policy today.

Welcome, home & apartment renters of Great Falls!

Renting a home? Insure what you own.

Safeguard Your Personal Assets

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Scott Schissler can help you build a policy for when the unanticipated, like an accident or a water leak, affects your personal belongings.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Great Falls. Contact agent Scott Schissler's office to discover a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Scott at (406) 761-8612 or visit our FAQ page.

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Scott Schissler

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.